Consultant Payments

Consultant Payments

SumoPayroll is a comprehensive payroll management system that provides features to add and manage consultant payments, whether they are individuals or clients.

It allows you to store and track their necessary information, such as PAN (Permanent Account Number), TAN (Tax Deduction and Collection Account Number), email, address, and GST (Goods and Services Tax) details. Additionally, SumoPayroll incorporates TDS (Tax Deducted at Source) calculations based on the services rendered by the consultants.

Here's how SumoPayroll can assist you in managing consultants:

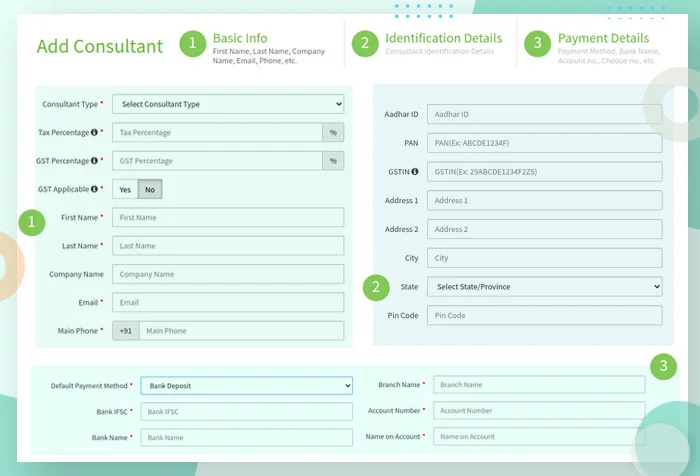

Consultant Profile Management

SumoPayroll enables you to create and maintain profiles for individual consultants or client companies. You can enter their relevant details, such as PAN, TAN, email, address, and GST information, ensuring accurate and up-to-date records.

Service Tracking

SumoPayroll, you can track the services provided by each consultant or client. This allows you to have a clear overview of the work rendered and the associated payments.

TDS Calculations

SumoPayroll automates the calculation of TDS based on the services provided by consultants. It ensures compliance with tax regulations by accurately deducting the applicable tax amount from their payments.

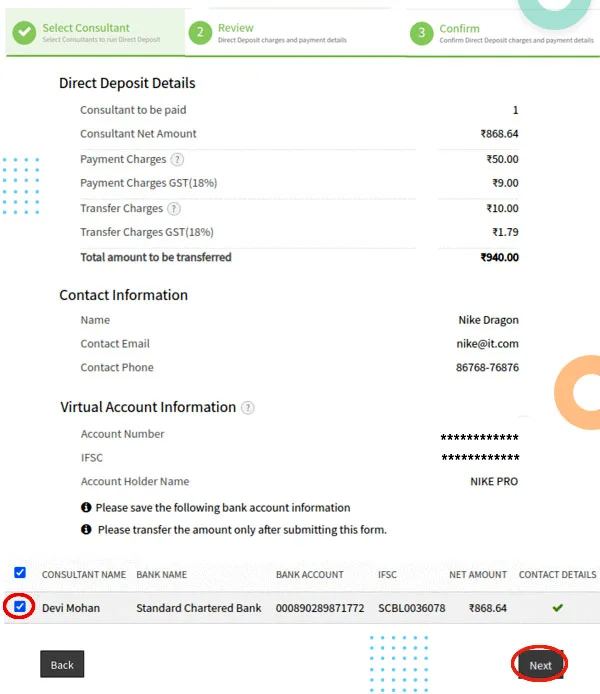

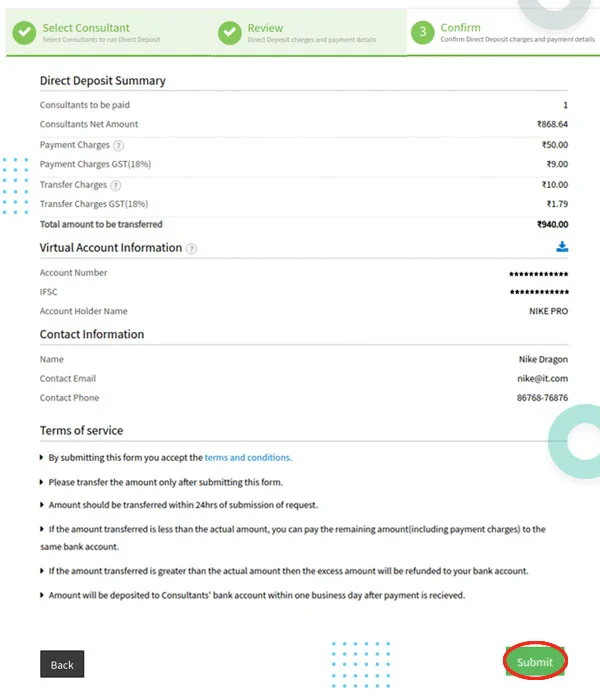

Payment Management

SumoPayroll facilitates the management of consultant payments. Besides, you can track the amounts payable to each consultant, maintain payment records, and generate reports for financial purposes.

Compliance and Reporting

SumoPayroll helps you stay compliant with tax regulations by automatically generating TDS reports and forms. These reports can be used for filing tax returns and ensuring accurate tax deductions.

Data Security

SumoPayroll ensures the security and confidentiality of consultant information. Basically, it employs robust security measures to protect sensitive data, such as encryption and access controls.

Moreover, by leveraging SumoPayroll's features, you can streamline your consultant management processes, automate TDS calculations, and maintain accurate records. This helps in efficient payment management, ensures compliance with tax regulations, and simplifies reporting requirements.