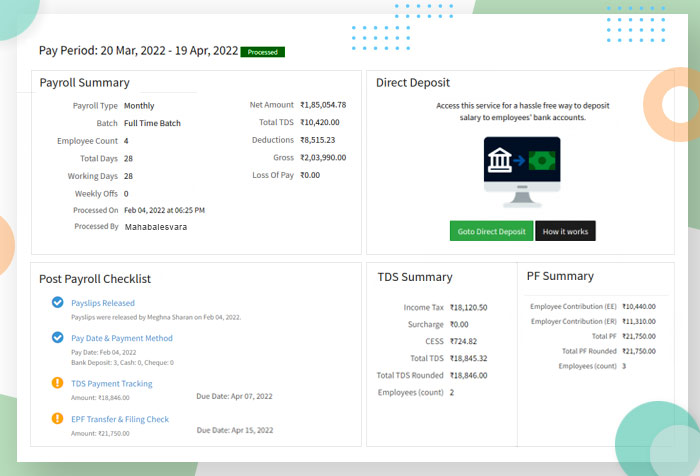

Error-free and streamlined payroll processing

User-friendly Payroll processing interface

Payroll Compliances

As per government norms, payroll compliances cover four verticals: Provident Fund, Employee State Insurance, Profession Tax, and Tax Deducted at Source.

Manage Payroll Batches

Run your payroll by creating different batches to segregate your employees by branches, departments or your own classification

Loans & Advances

Track your employee loans & advances. The disbursed loans or advances can be auto collected through payroll

Experience the ease of running the payroll with draft level to edit the payroll information if necessary changes arise & then finally run the payroll to process your employees salaries, generate payslips & reports

Payroll Reports

Generate monthly, quarterly & annual reports to view & download in spreadsheet or PDF format

Settlement Payroll

Resigned or terminated employees payroll can be run as a settlement payroll

Estimated Tax Sheets

Employees can download their estimated tax sheets to know what could be their tax deduction as per their current salary and according submit their IT savings

SumoPayroll is an accurate and easy-to-use cloud-based Payroll and HR application. It is among the top of India’s leading HR & Payroll software companies, packed with features that will help streamline your HRMS & Payroll.

SIGNUP FOR SUMOPAYROLL

Ready to run payroll using Sumo?

Try Now ! It's FREE for up to 10 employees. No credit / debit card needed.